Get Forbes' top crypto and blockchain stories delivered to your inbox every week for the latest news on bitcoin, other major cryptocurrencies and enterprise blockchain adoption.

Getty

BITCOIN’S LONE WHALE?

Researchers have cast fresh doubt over whether bitcoin's epic bull run happened organically, suggesting it may have been caused by a single, large player manipulating the bitcoin market.

According to a new report, an unidentified Bitfinex account used tether to manipulate the bitcoin price between March 2017 and March 2018 by creating unprecedented demand for the digital token. Over that period, the total market value of bitcoin soared from $16 billion to $326 billion.

MICROSOFT’S DIGITAL MINT

Microsoft is taking its secret platform for creating crypto tokens out for a test drive. The tech giant’s new crypto-assets mint lets enterprises design, issue and manage a wide range of digital assets. Several companies, including a video game outfit and a virtual reality platform, have already used the platform to create experimental tokens, while others like General Electric are waiting in the wings to create their own.

Big picture: Major companies like JPMorgan have already minted similar tokens, and Facebook is working with a group of companies like Uber, Spotify and Vodaphone on the Libra Project. Microsoft’s work, using the same standard as the other participating blockchain developers, could pave the way for an explosion of similar enterprise-grade tokens.

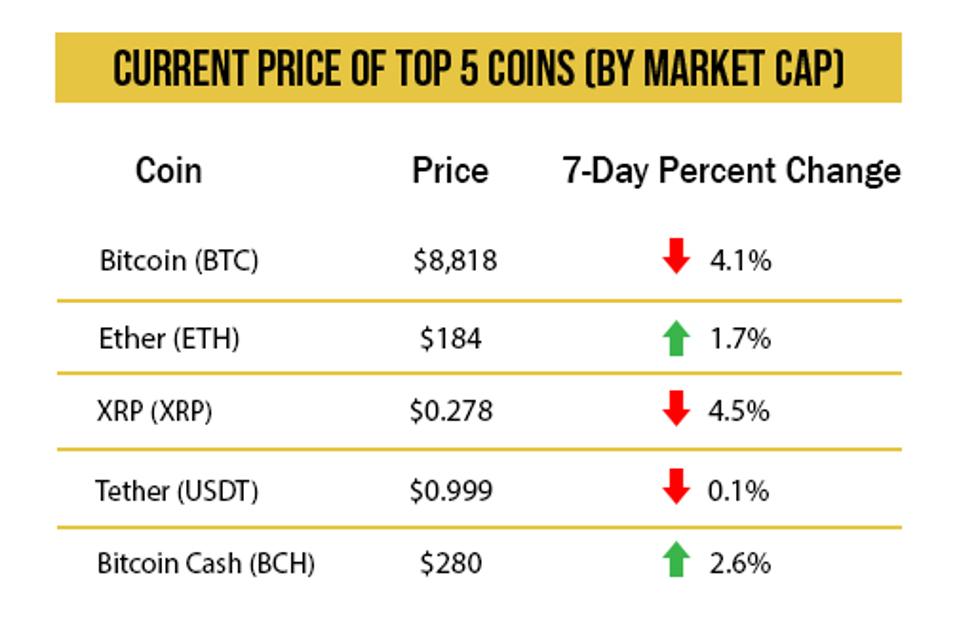

CRYPTO MARKETS

Stellar, the tenth largest cryptocurrency by market cap, saw its price soar this week after the Stellar Development Foundation "burned" more than half the digital token's supply—worth a staggering $4.7 billion.

Bitcoin remained largely flat following the news, while other smaller tokens, including Ripple's XRP, rose slightly.

Plus: one reason why bitcoin is better than gold.

Source: Messari. Prices as of 4:00 p.m. on November 8, 2019.

BLOCKCHAIN JOBS REPORT: POSTINGS UP, SEARCHES DOWN

Recent data gathered by popular employment site Indeed shows that over the past year, the share of blockchain and cryptocurrency job postings is up more than 25%, while the share of searches for those jobs has fallen by more than half. For the same period two years ago, Indeed saw a 14% bump these types of job searches.

The companies with the most job blockchain and crypto job postings on Indeed over the past year were mainstream powerhouses like Deloitte, IBM, Accenture and Cisco.

ELSEWHERE

Cryptocurrency Bank Vanished, Leaving Customers in a $16M Hole [Daily Beast]

Biglaw Powerhouse To Accept Bitcoin As Payment [Above The Law]

The ‘Bitcoin Rich List’ Has Grown 30% in the Last Year, But Why? [CoinDesk]

From Pigs to Party Fealty, China Harnesses Blockchain Power [Bloomberg]

https://ift.tt/33zLJQh

No comments:

Post a Comment